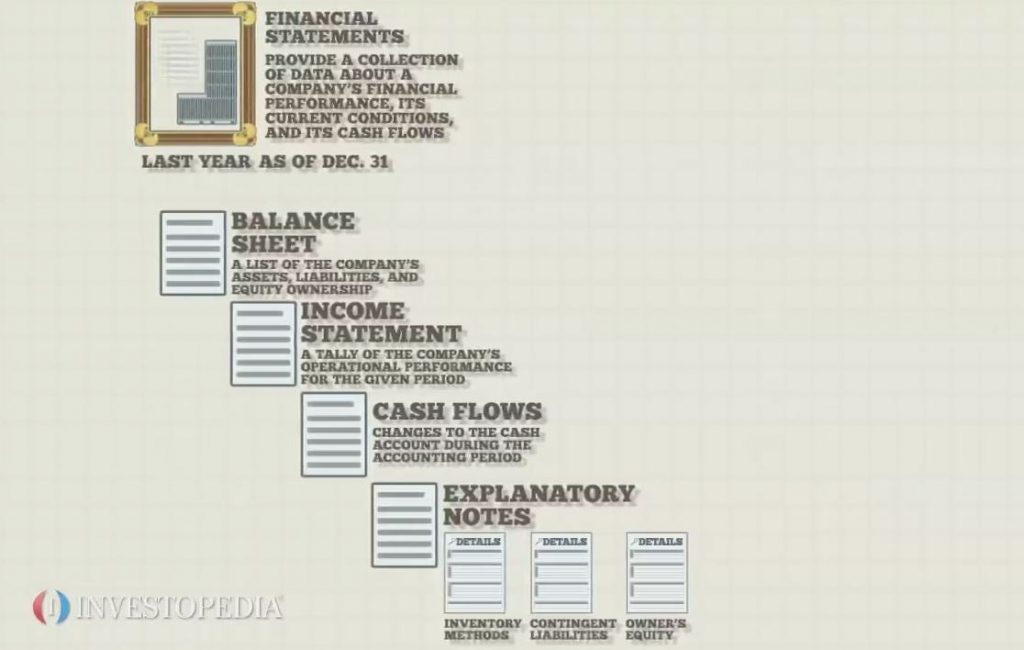

Fully prepared financial statements can provide funders a lot of information about the company’s current state of affairs. When you start a new business venture, the financial statements can be included with a business plan. Whether your a startup business preparing financial records or a company looking to grow and requires expansion capital, all company financial reports work on the same principles. Companies can use bank instruments to help manage cash flow problems within your organisation as well as using them as a method of trade finance. We have outlined the financial statement format as an example you can use: Income Statements ( profit / loss / revenue / forecast) Statements of Cash Flow (historic and current) Balance Sheets (assets / liabilities) Financial Ratios and/or break even analysis.

Working Costs Businesses keep financial reports to monitor performance for at least 5 years (some countries want 7-10 years for tax recording purposes). Financial reports are for record keeping purposes that are designed to measure and analyze the company’s cash flow, profit and loss on account and includes the balance sheet. Through a well designed financial statement, it’s easy to see a company’s expenditures and outlay and spot room for improvement and growth. Preparing your Financial Statements If you are a start up company it may not be to prove any income, one way to do this is by assumption in net income. Key Financial Indicators can be used as benchmarks that compare your business process and performances metrics to other competitior practices.

Profit and Loss Account

This is known as an income statement which shows the business’s financial performance typically over a 12 month period but are usually broken up into quarterly periods. An income statement should indicate: The profits — gross profits after all expenses paid out The expenses (cost of goods sold, salaries, rent, advertising, etc.) that match the revenues being reported or have expired during the accounting period The revenues (sales, service fees) that were earned as income during the accounting period of operations Forecast (projected profit and loss margins) This particular statement is shown as “net income”, the amount after deductions are made such as tax.

Cash Flow

This is the flow of money coming in and going out of the business. Cash flows record the difference between the opening and closing account balance. There are positive and negative ways in which a company can measure it’s cash flow operations (Examples are outlined in cash flow management) Cash Flow Management

The management of capital flowing in and out of a business is important to it’s survival. If the cash inflow into a business exceeds the outgoing (expenditures) it’s a sign that the business is healthy and strong. 3 ways of monitoring cash flow is through:

Operational Cash Flow —

Sell more goods or services, the company can also increase the selling price Reducing costs in areas such as employment, utility bills and loans Investment or liquid

Finincial Cash Flow —

Cash received through investments or liquid assets

Balance Sheet

A balance sheet is part of the overall financial statement and provides a snapshot of a company at any given date. There are many reasons why you would be asked for the balance sheet. If you are looking for funding, investors will ask to see this document as it reflects the result of all recorded accounting transactions since the business began. Creditors want to see this as it shows whether or not loans can be paid back as it indicates the company’s net worth. It’s always a good idea for companies to examine their assets to determine whether the company has enough current assets to pay its financial obligations. Working out whether you have a strong balance sheet isn’t hard because the two sides of the equation are always in balance. We measure the strength of a balance sheet by taking a closer look at the makeup of the two sides of the equation to find out where it might crack under pressure.

Balance sheets are divided into two main areas; what the business owns (assets) and owes (liabilities). Follow the link to read a balance sheet example. You can break down the balance sheet even further into organized classifications:

How to Prepare a Balance Sheet

Current Assets:

- Cash on Deposit

- Marketable Securities

- Account Receivables

- Inventories

- Intangible Assets

Current Liabilities: — these are all the company’s debt obligations

- Long Term Liabilities

- Deferred Revenues

- Owners Equity

- Costs -Debentures and Tax

Financial Accounting Ratios

A financial ratio or “accounting ratio” is a relative magnitude of two selected numerical values taken from a company’s financial statements. Financial ratios are used to compare a company against an industry average or other companies in order to benchmark or measure a company’s performance. Working Capital

The first way to strengthen your balance sheet is to repay the loan as quickly as possible. Failing to make the repayments could lead to liquidity problems and bankrupcy. There are many lending institutions offering debt refinancing packages. Can you improve on your current loans cureent interest rate? Loan term? Do you prefer a fixed rate? Check your company’s credit rating. Working capital is measured based on the current assets against the current liability. There are three main reasons why a business needs adequate working capital.

Pay staff wages and salaries. Settle debts and therefore avoid legal action by creditors. Benefit from cash discounts offered in return for prompt payment.

Company Assets

Fixed assets are know as tangible assets. Assets are instruments that a company owns or controls so as to benefit from their use in some way. For example, it could be the building that they own or equipment they use to make the company turnover. Current assets such as cash, inventory, accounts receivable and short-term investments are assets that the company plans to use up or convert into cash within one year from the reporting date.

Equity Shares

If the company sees this weak-point in the balance sheet, one way it can grow is by issuing new shares and gets good response from market thus increasing its cash liquidity. A company can add strength to its Balance Sheet in two ways:

- By leaving profit in the company (Retained Profit)

- By increasing the Share Capital If any, you can outline the stock holders equity interest Capital

Stock Deferred Stock Common Stock Additional Paid in Capital Retained Earnings Foreign Currency Treasury Stock

If any, you can outline the stock holders equity interest:

- Capital Stock

- Deferred Stock

- Common Stock

- Additional Paid in Capital

- Retained Earnings

- ForeignCurrency

- Treasury Stock

Financial Statement Tips

1. Many corporations include a ten-year summary in their financial highlights each year. This provides the investing public with information about a decade of performance.

2. Annual report contains financial statements, get a stamp of approval from independent auditors

3. Be realistic with the projected figures

4. Keep an eye on your business loan, can you get a better rate?

5. As savings rates are pretty low, there are many alternative investments that can yield high interest returns

atU WDH tdO aFJcc UjxmqqT CrATM

SwaAhW USExhYj CVCRrLh rgjoWD

Hey,

I came across something that might be useful for you…

There’s a free AI Business Summit coming up, and it’s all about how companies are using AI to automate, cut costs, and stay ahead of the competition.

Figured you might want to check it out: https://digital.aiedgesummit.com/

Hope it helps!

dxmMEiY LOyigsJ xse boqXj